Compound Interest - Compounder app for iPhone and iPad

Developer: Micah Wilson

First release : 28 Mar 2019

App size: 903 Kb

Unlock the Power of Compound Interest: See Your Money Grow Over Time

Ever wondered how much your savings could grow if you started investing today? With Compound Interest, you can instantly see the impact of saving and investing on your future wealth.

Start Saving Early and Watch Your Money Grow

What if you started saving for retirement at just 15 instead of 40? By contributing just $100 a week with a 7% return, you could accumulate over $2 million by the time you retire. You may wonder: "How is that possible when I’m only saving $260,000?" The answer lies in the power of compound interest. While your direct savings would total just over $250,000, the additional $2 million comes from the growth of your investments over time. Impressive, right?

Reach Your Retirement Goals with Ease

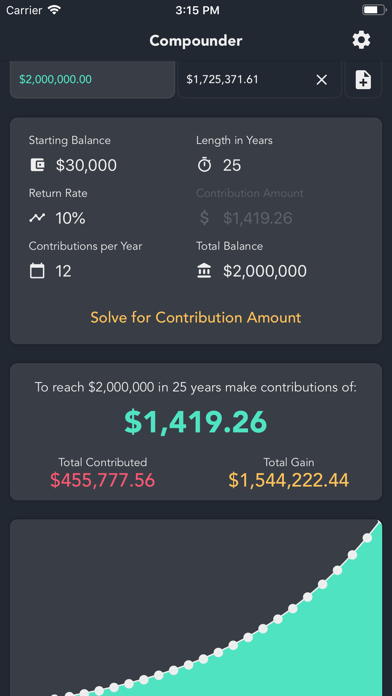

Already have a target in mind? You can easily adjust the settings to calculate your required contribution, desired return rate, or even the time frame needed. For example, if your goal is to retire with $5 million but youre unsure how much to save each month, simply switch to the "solve for contribution" mode, and the app will automatically calculate the amount you need to save to reach your goal.

Key Features:

Visualize Your Future: Easily calculate how your savings or investments could grow over the next 30 years (or more) with interactive graphs that break down your gains year by year.

Plan for Your Goals: Want to retire a millionaire? Set your target goal, and let the app calculate how much you need to save each month, the return rate, or how long it will take to get there.

Experiment with Different Scenarios: Test different saving strategies with the option to create multiple tabs. Try saving $100/week for 10 years, then adjusting your contributions—see the real impact of compound interest!

Flexible Calculations: Whether youre solving for total balance, contribution amount, return rate, or investment length, Compound Interest makes it easy to adjust your plan and reach your financial goals.

Advanced Tab References: Link one tabs balance to another for more complex calculations. Want to try saving more for a few years and less later? Its easy to reference and compare different strategies.

Customizable Themes: Switch between light and dark modes to suit your style.

Why Youll Love It:

See exactly how compound interest works and how small changes in saving habits can lead to huge financial gains.

Perfect for retirement planning, saving for big goals, or simply exploring the magic of compounding.

Simple, intuitive design for easy use no matter your financial knowledge.

Start planning today, and watch your future wealth grow with Compound Interest!